Who Owns Palantir? | Its Shareholders and Ownership Structure

Palantir Technologies Inc. (NYSE: PLTR) is one of the most talked-about companies in the AI and data analytics world. It creates software that helps governments and businesses analyze huge amounts of data to make smarter decisions. Its main platforms, Gotham and Foundry, are widely used in defense, intelligence, healthcare, and finance. Over the years, Palantir has grown from a secretive government contractor into a global AI software powerhouse. Many investors are not only interested in Palantir’s products but also often ask “who owns Palantir”, as understanding the shareholders helps gauge the company’s stability and future growth potential. In simple words, let us divide this up.

Palantir’s Growth and Market Presence

Palantir is among the largest beneficiaries of the AI boom. Its stock has gone up by over 420 percent in the past year, which indicates the confidence of the investors. The stock has, of late, been trading at an average of 157 per share and this makes the company worth approximately 382 billion.

The company has earned a reputation as a leader in AI-driven analytics. While co-founder Peter Thiel still owns a significant part of the company, the majority of shares are now held by large asset managers, institutional investors, and mutual funds. These investors are betting on Palantir’s long-term role in the AI economy.

Who Owns Palantir Top Shareholders?

Major institutional investors are the most frequently affected by the changes in the stock of Palantir, as some of them own a portion of the stock, and others are active hedge funds. The awareness of these top shareholders provides an idea of the people who have confidence in the future of Palantir.

Some of the largest shareholders include:

- The Vanguard Group: 204.8M shares (9.0%), worth ~$32.9B

- BlackRock Institutional Trust: 118.4M shares (5.2%), worth ~$19.0B

- State Street Global Advisors: 94.5M shares (4.2%), worth ~$15.2B

- Peter Thiel (Co-Founder): 70.9M shares (3.1%), worth ~$11.4B

- Geode Capital: 49.7M shares (2.2%), worth ~$8.0B

- Invesco (QQQ Trust): 46.5M shares (2.0%), worth ~$7.5B

- Norges Bank: 24.3M shares (1.1%), worth ~$3.9B

- Fidelity Management: 18.4M shares (0.8%), worth ~$3.0B

These investors are a mix of passive index fund giants and active managers, showing both stability and strong belief in Palantir’s growth.

Top Institutional Holders

| Shareholder | Shares Held | % of Company | Market Value (USD) |

| Vanguard Group | 204,800,000 | 9.0% | 32.9B |

| BlackRock | 118,400,000 | 5.2% | 19.0B |

| State Street | 94,500,000 | 4.2% | 15.2B |

| Peter Thiel | 70,900,000 | 3.1% | 11.4B |

| Geode Capital | 49,700,000 | 2.2% | 8.0B |

| Invesco QQQ Trust | 46,500,000 | 2.0% | 7.5B |

| Norges Bank | 24,300,000 | 1.1% | 3.9B |

| Fidelity Management | 18,400,000 | 0.8% | 3.0B |

Mutual Funds and Passive Ownership

Many of Palantir’s shares are also held by mutual funds and ETFs, which provide stability to the stock. These large funds tend to hold shares for the long term, rather than trade them actively. Some of the top mutual fund holders are:

- Vanguard Total Stock Market ETF: 67.5M shares (2.85%)

- Vanguard S&P 500 ETF: 52.6M shares (2.22%)

- Invesco QQQ Trust: 46.6M shares (1.97%)

- Fidelity 500 Index Fund: 26.9M shares (1.14%)

- Government Pension Fund Global: 26.1M shares (1.10%)

These funds make Palantir widely held across global portfolios, which is a positive sign for investors looking for stability.

Top Mutual Fund Holders

| Fund Name | Shares Held | % Holding | Market Value (USD) |

| Vanguard Total Stock Market ETF | 67,555,522 | 2.85% | 12.1B |

| Vanguard S&P 500 ETF | 52,654,631 | 2.22% | 9.4B |

| Invesco QQQ Trust | 46,641,593 | 1.97% | 8.36B |

| Fidelity 500 Index Fund | 26,963,546 | 1.14% | 4.83B |

| Government Pension Fund Global | 26,168,992 | 1.10% | 4.69B |

Insider Ownership and Trading

The other indicator of importance is insider activity. The CEO Alexander Karp, and the COO, Shyam Sankar, are the stockholders who have sold certain shares recently. This is the sort of sales that is mostly regarding the compensation or diversification that is planned, but not necessarily a deficiency in trust towards the company.

- Alexander Karp (CEO): Sold ~96K shares at ~$155 and 78K shares at ~$156, mostly from compensation.

- Shyam Sankar (COO): Sold between 775 to 40K shares at $154–$162 and exercised/purchased 30K shares.

Overall, insider buying has been limited, which suggests executives are cautious about increasing their holdings at current valuations.

Recent Insider Trades

| Insider | Position | Shares Sold | Price Range (USD) |

| Alexander Karp | CEO | 96,000 | 155 |

| Alexander Karp | CEO | 78,000 | 156 |

| Shyam Sankar | COO | 775–40,000 | 154–162 |

| Shyam Sankar | COO | 30,000 (Purchased/Exercised) | — |

What the Ownership Data Shows

Palantir’s ownership is anchored by large institutional and passive investors, which makes the stock broadly stable.

- Passive funds like Vanguard and State Street keep the stock in long-term portfolios.

- Hedge funds like Jane Street, Millennium, and Squarepoint have increased their stakes, showing confidence in Palantir’s future.

- Some large holders like BlackRock have reduced positions, showing that not all investors are confident after the recent rally.

- Insider sales suggest management may be taking profits or diversifying rather than losing confidence.

This mixed picture reflects a healthy balance between stability and active investor interest.

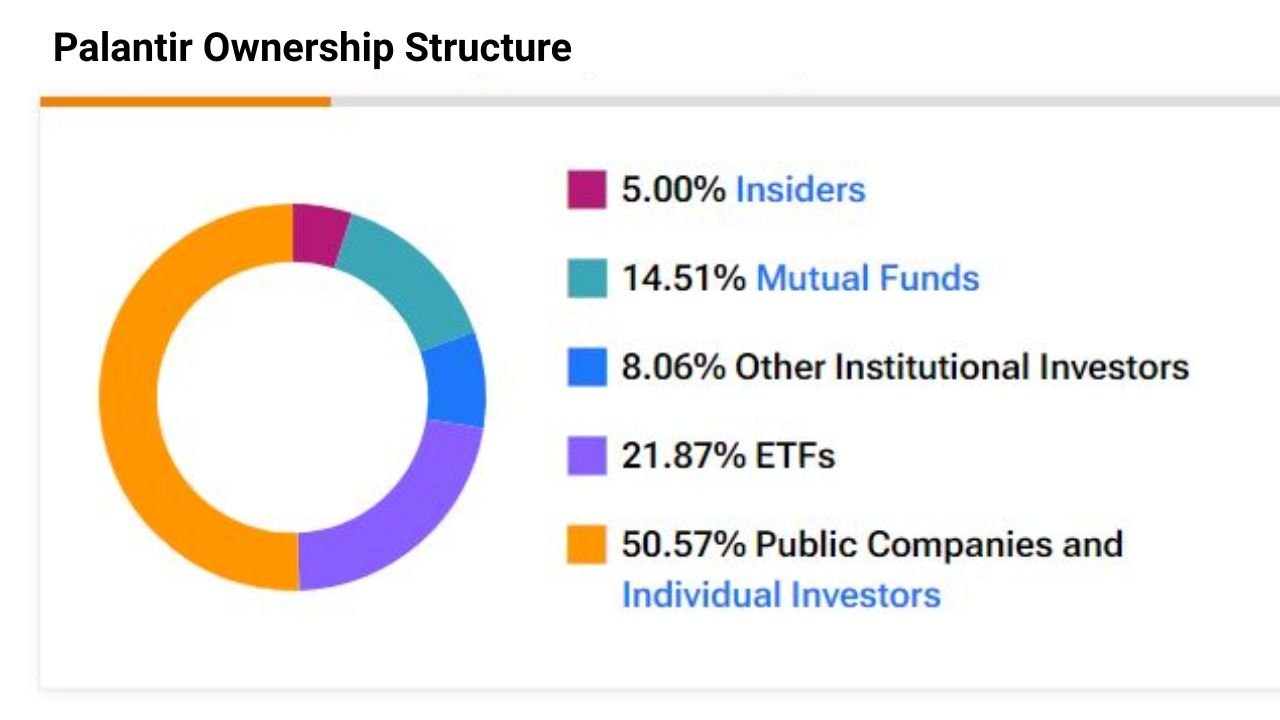

Ownership Composition

Palantir’s overall ownership can be grouped as:

- Mutual Funds & ETFs: 28.6%

- Other Institutional Investors: 23.7%

- Public & Retail Investors: 47.7%

This shows that nearly half of the company is held by public and retail investors, while large funds and institutions provide the backbone of stability.

Table: Ownership Composition

| Type | Shares Held (M) | % of Total | Market Value (USD B) |

| Mutual Funds & ETFs | 678.55 | 28.6% | 121.68 |

| Other Institutional Investors | 561.61 | 23.7% | 100.71 |

| Public & Retail Investors | 1,130.0 | 47.7% | 203.03 |

| Total | 2,370 | 100% | 425.43 |

Conclusion

“Who Owns Palantir” Palantir’s ownership is a mix of founder stakes, institutional investors, and mutual funds. Large, passive funds provide stability, while active hedge funds indicate strong belief in growth potential. Insider activity shows careful management of stock holdings.

As an investor, it is essential to know the owner of Palantir as it would allow determining the stability of the company as well as its future in the area of AI and data analytics.

Palantir is a well-institutionalized company that continues to gain importance to AI and can expand further. Having the information on the major company shareholders and the insider promptings, investors will be able to make well-informed choices regarding becoming a part of the AI-driven growth narrative that Palantir can be.

Want To Know About: Palantir Stock Price Today: AI Growth, Returns, and Market Risks