Palantir Share Price (PLTR): Growth, Valuation Risks, and What Day Change Means in the Stock Market

The stock market is full of companies that attract attention, but one of the most talked about names in 2025 is Palantir Technologies. Many investors closely watch the Palantir share price because the company has positioned itself as a leader in artificial intelligence and data analytics. When looking at the PLTR share price, traders often wonder not just about the current value but also how it may change in the future.

For beginners in the stock market, terms like “day change” can also be confusing. Simply put, a day’s change in the stock market means the difference between the opening price and the latest trading price of a stock within the same day. If the number is positive, it means the stock gained value, and if it is negative, the stock declined during that day’s trading session. Understanding this helps investors track short-term price movements more effectively.

The firm has developed its own niche in the AI industry owing to its solid government and commercial business. It also generates much revenue on this side of the business since originally it was the role of its AI software to serve the U.S. government agencies.

Nonetheless, the business market has been expanding in recent years, particularly in the United States. Palantir’s continued Dashboards can assist organizations in the analysis of large amounts of data, the processing of AI-based insights, and informed decision-making. It has an artificial intelligence platform referred to as AIP which enables them to automate their processes and use AI agents who facilitate smarter and quicker decision-making.

The progress in finance of Palantir is impressive. The sales generated by commercial activities increased by 47 times compared to the same time last year to stand at 451 million, and those made by the government contracts went up by 49 percent to 553 million.

This adds up to a combined growth rate of nearly 48% for the quarter, showing strong demand across both areas. These numbers are one of the biggest reasons the Palantir share price has been rising so quickly. Investors have rewarded the company for its performance, pushing the PLTR share price up by more than 144% in 2025 alone.

However, while growth is strong, valuation is a major concern. Since 2023, Palantir’s revenue has increased by about 80%, but its stock price has surged more than 2,700%.

This unusual gap shows that the market has placed an extremely high valuation on the company. Right now, Palantir trades at about 135 times its sales, making it one of the most expensive stocks in the AI sector. When a stock becomes so highly valued, it often means that investors have already priced in several years of future growth. This creates risks because even if the company performs well, the stock may not rise further if expectations are already too high.

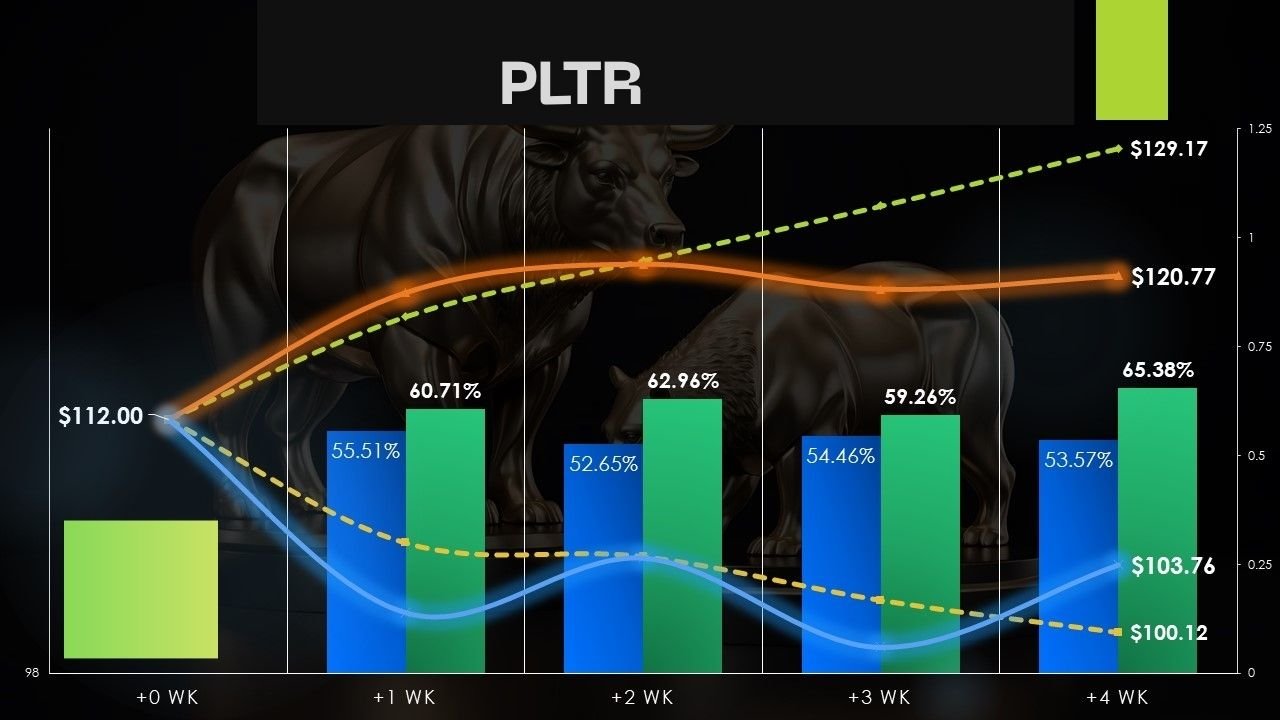

In order to conceive the potential results, analysts have attempted to predict the potential form of Palantir three years down the line. Assuming that Palantir retains a healthy 50 percent growth rate and is able to generate a 35 percent profit margin, we may estimate the firm could generate half a billion dollars in revenue and generate profits to the tune of approximately 4.1 billion dollars.

This would be a huge turnaround in comparison with the $3.4 billion in sales and $773 million in profit it earns as is happening today. However, even at this much lower valuation, the market would be pricing Palantir at 50 times forward earnings, which in turn would give the company a market cap of around 205 billion.

This might translate to a share price of approximately 86.30 dollars based on recent share quotients, and this is in fact much lower than the current share price. This indicates how overvaluation may cause business growth and share price to lose in relation.

Here’s a simple breakdown to compare Palantir’s situation today with its potential outlook:

| Metric | Today (2025) | In 3 Years (Estimate) |

| Revenue | $3.4 billion | $11.6 billion |

| Profit | $773 million | $4.1 billion |

| Growth Rate | ~48% | ~50% |

| Market Valuation (Est.) | $60B+ | $205B |

| Approx. PLTR Share Price | $200+ | $86.30 (est.) |

This table shows that while Palantir is growing fast, the current PLTR share price may not be justified based on long-term earnings potential. Investors need to be careful not to confuse strong company performance with guaranteed stock gains, especially when so much future success is already factored into the valuation.

Palantir remains a strong player in artificial intelligence and continues to expand its influence across industries. Its products are powerful, its revenue is climbing, and its customer base is growing.

However, with such a high premium placed on the stock, it could face headwinds even as it delivers strong results. The company itself is not weak, but the Palantir share price reflects extreme optimism that may not be sustainable. For investors, this means it could underperform compared to other AI companies with more reasonable valuations.

After all, learning about phenomena such as day change in the stock market is a good way to follow short-term trends, and the long-run success will be determined by whether the company will prove worthy of all the expectations put in its valuation price. Palantir is yet to provide the big things but investors are advised to evaluate risks before jumping on the bandwagon depending on hype on the price of the PLTR shares.

Also Read About: Palantir Technologies Inc (PLTR) May Transform Government Efficiency, According to Jim Cramer