Palantir Earnings: Market Signals, Growth Trends, and Insights

Some stocks rise quietly. Others spark debates. Palantir is in the middle of all these and is continually redefining what is expected of them, making traders reconsider how the long-term demand contributes to the short-term movement. When you track Palantir Earnings you can see trends that indicate how predictability and momentum can be mutually effective in a rapidly moving industry. And as long as such figures continue to outwit forecasts, one wonders what is behind this predictability.

Investors want clarity. They want signals about revenue strength, cost efficiency, and contract momentum. Palantir Earnings give those signals if you know what to look for. This article breaks down that pattern with simple explanations, real examples, and practical insights that help both beginners and seasoned traders understand why this stock keeps drawing attention.

What Is Palantir Earnings?

By Palantir Earnings, people are referring to the quarterly and annual financial performance of the Palantir Technologies. These figures assist investors in knowing the success of the company in transforming the demand into revenue. The reports put emphasis on such measures as earnings per share (EPS), revenue growth, cash flow, and expansion of deals. Such information forms anticipations regarding the future performance.

Companies like Palantir rely on high-quality earnings because it helps the market identify how sustainable the growth really is. When an earnings quality ranking remains “high” for months or even a full year, it sends a clear message. It tells investors the reported numbers aren’t inflated or distorted by short-term events. Instead, it signals durability-a key point for valuation.

Why Palantir Earnings Matter for New and Experienced Investors?

Many new investors worry about volatility. They want a stock that feels predictable without being boring. Palantir Earnings create that middle space. If the data stays strong, people trust the company’s ability to scale. When the revenue curve rises with fewer dips, investors feel more confident adding the stock to their portfolios.

Experienced traders see earnings differently. They study margins, operational costs, and how recurring revenue is expanding. When those numbers show discipline, they consider it a long-term indicator of value. That’s why earnings hold weight. They show how well Palantir converts innovation into financial output.

Below is a simple comparison table showing how earnings metrics support investor confidence:

Why Earnings Matter?

| Investor Type | What They Look For? | Why It Matters? |

| New Investors | EPS growth, simple trends | Helps them enter the market with clarity |

| Active Traders | Margins, deal activity | Signals timing for buying and holding |

| Long-Term Investors | Recurring revenue, cash flow | Shows durability and predictable expansion |

Breaking Down the Recent Palantir Earnings Performance

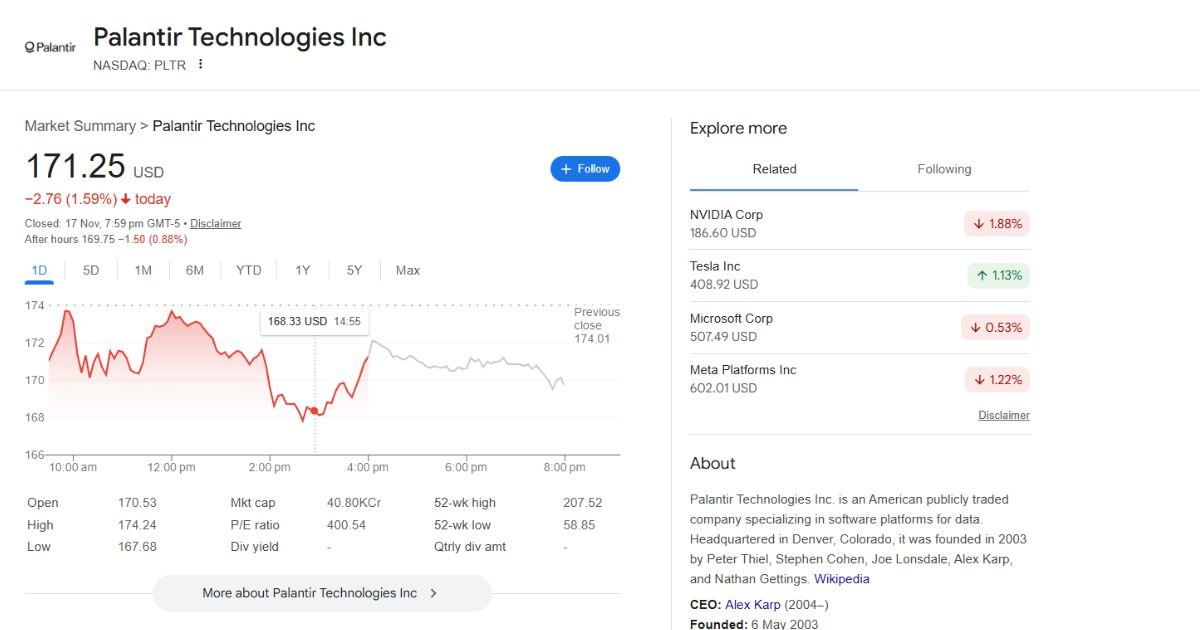

Each Palantir Earnings cycle provides new knowledge on what is happening behind the scenes. In the recent times, EPS was reported at 1.00, which equated with the estimate EPS of 1.00. It does not always make headlines to match estimates, but it is sure to be stable. The trends of revenue also proved stable, with high government contracts and an observable stimulus of commercial customers.

One surprising detail is how quickly Palantir adapts its platforms for specialized sectors. That agility plays a big role in its earnings. As government agencies drive long-term demand, commercial customers provide higher-margin opportunities. Together, these two engines keep earnings consistent.

Here’s a sample table breakdown reflecting common metrics analysts look at:

Sample Earnings Indicators

| Metric | Estimated | Reported | Outcome |

| EPS | 1.00 | 1.00 | Stable, aligned |

| Revenue Growth | Expected steady | Delivered steady | Positive consistency |

| Earnings Quality | High ranking | 51 weeks consecutive | Reinforces sustainability |

How Palantir Uses Data to Strengthen Earnings Quality?

Good earnings don’t come from luck. They come from structure. Palantir relies on a technology ecosystem built to solve complex data problems. When agencies use those tools, they stick with them for years. That loyalty drives predictable revenue. It’s one reason Palantir Earnings often show reliable patterns.

The company’s earnings quality ranking is a strong indicator of how transparent and consistent its reporting is. Staying at a “high” ranking for 51 consecutive weeks shows the market that Palantir’s financials are durable. It means earnings aren’t propped up by one-time events. They reflect actual, repeatable performance.

It is this predictability that makes Palantir stand out in contrast to most high-growth tech firms whose rise and falls are unpredictable. Palantir does not take that way very often. It is constructed gradually and provides regularly.

Why Consistency in Palantir Earnings Signals Long-Term Value?

When a company increases revenue but fails to maintain margins, earnings suffer. Palantir avoids that trap by expanding cautiously. Instead of chasing volume at any cost, it grows through strategic contracts. Each new deal builds on work done before, which reduces operational strain.

This creates compounding efficiency. And that efficiency shows up directly in Palantir Earnings. Investors appreciate companies that grow naturally without burning excessive capital. Palantir’s structured approach supports a long-term path that appeals to risk-sensitive buyers.

Here are a few reasons consistency matters:

- Predictable earnings attract institutional investors.

- Stable growth reduces the likelihood of sharp selloffs.

- High earnings quality supports better valuation multiples.

- Predictability helps analysts model long-term performance more accurately.

How Government and Commercial Contracts Shape Earnings Momentum?

Government deals give Palantir stability. Commercial deals give Palantir acceleration. Together, they build a balanced earnings engine that produces strong results even in complicated market environments. Recent partnerships, such as those tied to aviation and defense analytics, show how quickly the company expands its reach.

These collaborations contribute significantly to Palantir Earnings, particularly due to the fact that most Government contracts have a long payback period. There is the provision of long-term contracts that ensure repetitive revenue. And once commercial clients purchase the tools at Palantir, they can begin with pilot projects, which can grow into large scale deployments later. This 3-tiered model of growth maintains the level of earnings, even at the time when some sectors have slackened down.

Palantir Earnings and Stock Price Behavior: A Useful Connection

Stock prices and earnings do not necessarily go hand in hand but the correlation is important. In cases where Palantir Earnings are good, the stock will develop support at the high levels. Earnings is one of the evidences portrayed by investors that the company can justify its valuation.

Use a simple example Palantir reported a stable EPS, and high earnings quality ratings made traders think that the company might continue growing. This confidence over time was created even in the general market change.

Below is a simple behavior chart in table form:

How Earnings Influence Stock Sentiment?

| Earnings Trend | Stock Reaction | Investor Perception |

| Stable EPS | Gradual price support | Positive, long-term growth |

| Beat Estimates | Short-term upward moves | Strong demand and confidence |

| Miss Estimates | Temporary pressure | Questions about momentum |

What Analysts Watch Inside Each Palantir Earnings Report?

Analysts look deeper than headline numbers. They examine details most new traders ignore. These hidden factors reveal how well the company manages expenses and executes strategy.

Here’s what analysts pay attention to:

- Whether government revenue is expanding faster than expected

- Adoption rate of commercial tools across industries

- How much free cash flow the company generates

- Whether margins are improving quarter over quarter

- Long-term contract wins that may not reflect in immediate revenue

These details often shape the market reaction more than EPS itself. Strong supporting numbers help analysts justify positive forecasts, especially in fast-growing sectors.

Case Study: How a Stable EPS Strengthened Investor Trust?

A great real-world example comes from the moment Palantir reported EPS at 1.00, matching analyst expectations exactly. Instead of shocking the market, it reassured it. Matching numbers can be a powerful message. It tells investors the business operates predictably.

Traders prefer reliability more than surprises. The consistent EPS supported a narrative investors already believed-that Palantir’s data platforms are expanding steadily. This stability helped maintain confidence during a period when several tech stocks faced corrections. This case shows how even modest results can strengthen the story behind Palantir Earnings.

Palantir Earnings and the Role of Long-Term Contracts

Some companies rely on one-time revenue spikes. Palantir doesn’t. It uses multi-year contracts to anchor future performance. These contracts often include renewals and add-on services. As the customer needs grow, Palantir grows with them.

The model provides Palantir Earnings with the power to remain consistent. Volatility is decreased through long-term deals. They also assist the company in making more investments in new expansions and tools. This strategy is similar to those of the enterprise companies that rule their industries based on sturdiness, rather than buzz.

Investor Behavior During Major Palantir Earnings Announcements

During each major earnings week, there’s a noticeable shift in trading volume. Traders prepare for short-term moves. Long-term investors wait for confirmation on strategy. Everyone watches key details like margins, cost efficiency, and contract activity.

These behaviors create temporary volatility. But once the data settles, Palantir Earnings provide direction. If the numbers confirm the company’s growth pattern, both retail and institutional investors become more confident.

This cycle happens every quarter, building a rhythm in how the market interprets Palantir’s progress.

The Future Outlook: Where Palantir Earnings Could Go Next?

High quality earnings is a good predictor of high future performance. As long as Palantir is able to maintain government contracts and increase commercial use, revenue may steadily increase. The investors would want the company to further penetrate in areas such as logistics, aviation and data governance.

Palantir Earnings in the long run could be positively impacted by the international investment in digital infrastructure and the increase in the demand to use analytics tools. Businesses require more intelligence. The governments should have better intelligence systems. Palantir is at the intersection point of the two needs.

Conclusion: Why Palantir Earnings Still Matter Most?

Each stock has a story at the end of the day. In the case of Palantir, that narrative is told with Palantir Earnings, which show the extent to which the company is stable and innovative at the same time. The income reveals discipline, strength of contract and dependable growth trends. Investors are confident in such numbers as they are based on actual performance but not exaggerated estimates. With the trend going in the same direction, Palantir Earnings will still be one of the best indicators of value in the long-term to any investor tracking the stock.

Also Read About: Will Palantir Stock Hit $1000? Palantir Stock Price Prediction 2040