Will Palantir Stock Hit $1000? Palantir Stock Price Prediction 2040

Palantir Technologies has become one of the most discussed companies in the tech and AI sector. Investors see it as a long-term play in the world of data analytics and artificial intelligence. The question that keeps coming up is: what will the palantir stock price prediction 2040 look like?

This article breaks down the company’s current position, revenue growth, technology, potential, risks, and realistic price forecasts. The tone is conversational and easy to read, with all details explained in short, complete sentences.

What Is Palantir Technologies?

Palantir Technologies is a US-based software company that creates the programs that help both the government and the business sector in processing large volumes of data. With their platforms – Palantir Gotham, Foundry, and Apollo – they convert raw complicated data into clear and friendly data that can be used. The applications that these instruments have spread out over different sectors such as the security of the nation, medical care, the economy, and the production of goods.

The firm went public in 2003 and made a name for itself in the government sector. It was a major contributor to the U.S. intelligence agencies’ anti-terrorism efforts and the tracking of significant global threats. In due course, Palantir ventured into the private sector. Presently, its expansion is largely dependent on the commercial clients. This transition is important for the stock price prediction 2040 as commercial contracts lead to recurring revenue and scalability.

Palantir Stock Price Prediction 2040: Palantir’s Core Platforms

The company has developed a suite of products that work together to form an ecosystem. Knowing these products is a must if one wants to understand the company’s worth and the palantir stock price prediction 2040.

| Platform | Purpose | Key Markets |

| Gotham | Data integration and analysis for government and defence agencies | Defence, security, intelligence |

| Foundry | Operational platform for commercial clients | Manufacturing, energy, finance |

| Apollo | Software delivery and updates platform | Both government and private sectors |

| AIP (Artificial Intelligence Platform) | AI-driven analytics for decision-making | All sectors seeking AI automation |

Each product brings Palantir closer to becoming a critical infrastructure player for data analytics. If demand continues to grow, the stock price prediction 2040 could reach new heights.

Financial Scenarios: Where Could Palantir Be by 2040?

Below is a simplified model of what different growth outcomes could look like for the palantir stock price prediction 2040.

| Scenario | Annual Growth Rate | Estimated Revenue (2040) | Valuation Multiple | Estimated Market Cap | Interpretation |

| Base Case | 15% | $35 billion | 10× | $350 billion | Solid but below trillion-dollar level |

| Growth Case | 20% | $70 billion | 12× | $840 billion | Potential near-trillion valuation |

| Aggressive Case | 25%+ | $100 billion + | 15-20× | $1.5-2 trillion + | Possible if AI adoption explodes |

If the company maintains 20–25% annual growth, the stock price prediction 2040 could reach valuations near or beyond $1 trillion. Slower growth, however, keeps it under $500 billion.

Palantir Stock Price Prediction 2040: Revenue and Valuation (Simplified)

Before Figure, it is definitely to comprehend changes in Palantir’s revenue growth over time. Three main factors that influence the future performance of the company are: ongoing deployment, expansion in the commercial markets, and global demand for AI-based solutions. Table outlined the possible effects of these factors on the revenue and valuation trends until 2040.

| Year | Revenue (Projected, $ Billion) | Growth % | Forward P/S Multiple | Estimated Market Cap ($ Billion) |

| 2025 | 3.0 | 18 | 16 | 48 |

| 2030 | 7.5 | 20 | 13 | 98 |

| 2035 | 18.0 | 22 | 12 | 216 |

| 2040 | 40.0 – 100.0 | 20-25 | 10-15 | 400 – 1500 |

This gradual scaling shows how small improvements each year can lead to massive compounding. That is why the stock price prediction 2040 excites long-term investors.

Current Market Performance

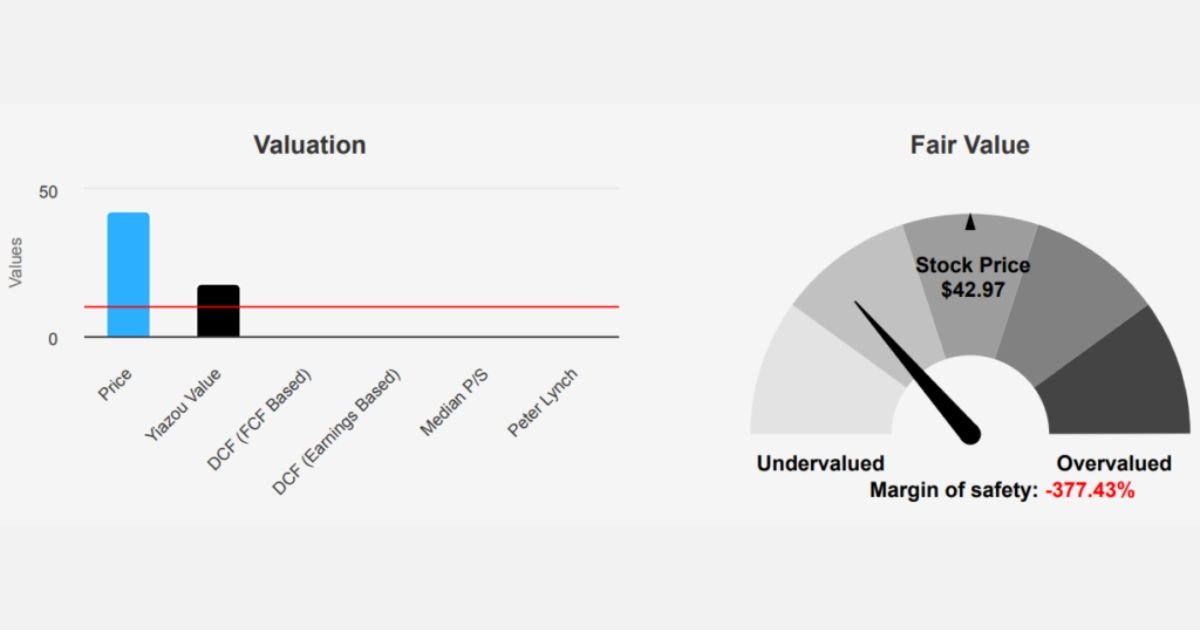

Palantir’s performance in recent years shows mixed signals. On one hand, it is growing revenue steadily. On the other, valuation concerns remain.

- Revenue (2024): around $2.7 billion.

- Market capitalization: approximately $47 billion.

- Commercial revenue growth: over 40% year-over-year in the U.S.

- Government revenue growth: slowed to 16% in early 2024.

Investors like the progress in commercial markets but worry about the high price-to-sales ratio-above 17×. Typically, software companies with similar growth trade around 7× to 13× sales. For Palantir to justify its valuation, it must accelerate growth. This balance directly influences the palantir stock prediction of price 2040.

Why Investors Are Watching Palantir Closely?

Many investors have a perception that Palantir might turn out to be the following company with a market cap of over a trillion dollars. They characterize it as a mix of a defence contractor and a cloud-data giant. The reason for the attraction is the rising influence of artificial intelligence. When there are more companies that use AI-driven systems, it might turn out that Palantir’s tools are the only ones that are indispensable.

In fact, the company has been instrumental in diverse areas such as logistics, manufacturing, and energy. For example, Airbus turned to Palantir’s platform to ramp up airplane production efficiency. Kinder Morgan used it to anticipate changes in natural gas demand. These kinds of applications from day to day life are evidence that Palantir’s software is not a concept – it is a solution to business problems that exist. This is the reason behind the majority of long-term forecasts being in favor of palantir stock price prediction 2040.

Key Growth Drivers

Palantir’s continued success over the long run is contingent upon various growth levers. We can analyze how each one of them can impact the Palantir stock price prediction 2040.

1. Expansion into Commercial Markets

The commercial market represents the largest opportunity for Palantir. While the government sector is a source of stability, commercial clients basically offer scalability. As a result, the revenue base of Palantir could be multiplied by 2040 if we witnessed the continuous addition of large corporate accounts on a quarterly basis.

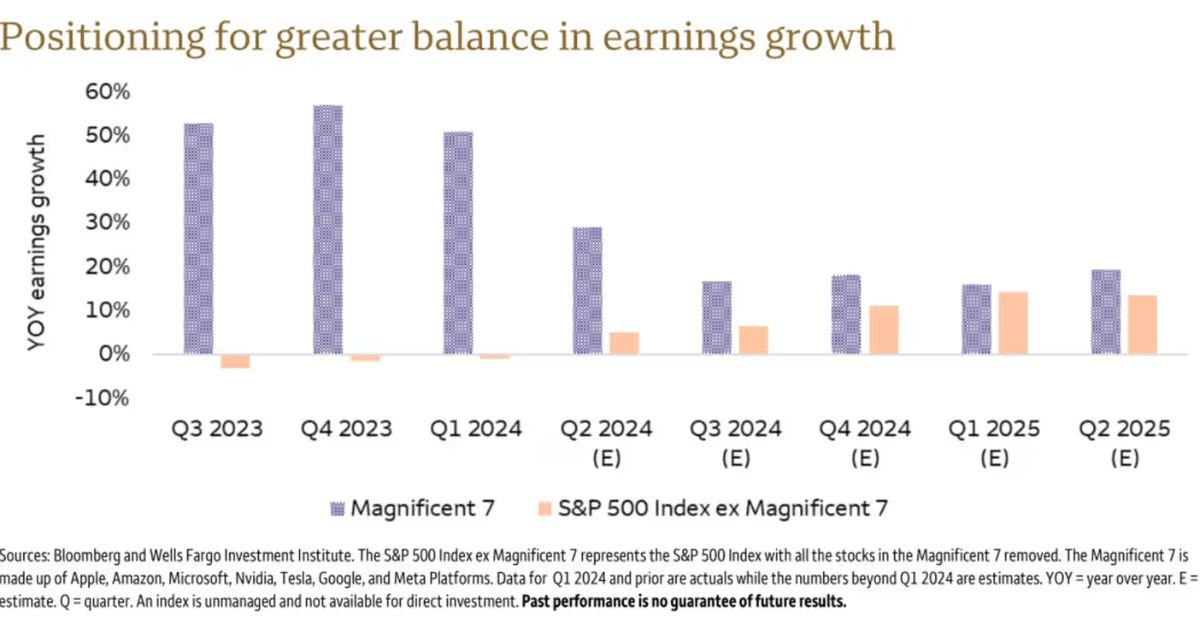

2. Artificial Intelligence Adoption

Artificial Intelligence adoption is the primary driver for Palantir’s future. Its Artificial Intelligence Platform (AIP) is designed to embed machine learning in business processes. Given that AI is to become a standard, Palantir might be the one company that supports enterprise AI thus strengthening the a long-term Palantir stock price prediction 2040.

3. Global Expansion

Palantir is not hurrying but is gradually getting into foreign markets. The growth in Asia, Europe, and the Middle East is offering new revenue streams. Besides, spreading risks among various regions reduces the risk of a decline in the U.S. government spending and consequently supports a stronger palantir stock price prediction 2040.

4. Profit Margins and Cash Flow

By scaling, Palantir’s software-as-a-service model can result in higher profit margins. The profits could increase dramatically when development and infrastructure costs have leveled off. Investors are attracted to companies with sound margins and they will buy shares driving the palantir stock price prediction 2040 higher.

Risks That Could Limit Growth

Every forecast carries uncertainty. For Palantir, several risks could influence the palantir stock price prediction 2040.

- High valuation: The stock is already expensive. Slower growth could trigger multiple compression.

- Dependence on government contracts: Losing key government deals could hurt revenue stability.

- Competition: Tech giants like Microsoft, Google, and Snowflake are expanding into analytics and AI.

- Regulatory challenges: Government work brings scrutiny over privacy and data security.

- Execution risk: Scaling commercial operations globally is not easy. Any slowdown affects the forecasted path of the palantir stock price prediction 2040.

Could Palantir Become a Trillion-Dollar Company?

If Palantir wants to have a market cap of $1 trillion by 2040, its valuation has to be more than 20 times the current one. This situation calls for a lot of growth, good profit rates, and the company being the leader in AI for quite some time.

With a 25% revenue growth each year, the company could be making close to $100 billion by 2040. A 15× sales multiple would convert that into a $1.5 trillion valuation. It is very difficult, but it is not out of the question because of the increasing global demand for AI data infrastructure.

Furthermore, with 20% growth every year, the revenue would be around $70 billion, and the valuation would be $840 billion, which is still very large. So, the palantir stock price prediction 2040 leans more towards being a positive one.

What Should Investors Watch Next?

For those tracking the palantir stock price prediction 2040, here are the most critical indicators to monitor:

- Commercial customer growth: The more corporate clients, the better the revenue mix.

- Government contract renewals: They ensure a stable base.

- Profit margins: Rising margins confirm scalability.

- Free cash flow: Strong cash flow allows acquisitions and R&D expansion.

- AI adoption metrics: The wider the AIP platform adoption, the higher the potential multiple.

These signals provide real-time feedback on how achievable the palantir stock price prediction 2040 truly is.

Challenges Ahead

Despite strong potential, Palantir faces obstacles:

- Scaling commercial operations across countries with different data-laws is complex.

- Maintaining innovation speed while complying with regulations is demanding.

- Competing with giants such as Google Cloud and Amazon Web Services requires constant R&D spending.

Any of these challenges could slow growth and soften the palantir stock price prediction 2040.

Expert Consensus

Analysts are split. Some predict slow growth due to government dependency. Others expect AI adoption to create exponential expansion. Here’s a simplified consensus view:

| Analyst Group | Forecast View | Long-Term Target Price | Outlook for 2040 |

| Optimists | Strong AI adoption | $600 – $800 per share | Very bullish |

| Moderates | Gradual growth | $300 – $400 per share | Stable growth |

| Skeptics | Slower execution | $150 – $200 per share | Underperformance |

Even the moderate camp sees upside compared to current prices, reinforcing interest in the palantir stock price prediction 2040.

Long-Term Investment Perspective

Long-term investors often overlook short-term volatility. The palantir stock price prediction 2040 fits this mindset. Those who believe in the company’s AI future may see decades of compounding growth.

Patience is crucial. Revenue growth, profitability, and strategic partnerships will evolve over years, not months. Investing in Palantir today means betting on the global shift toward AI-driven operations.

Conclusion

The palantir stock price prediction 2040 presents a wide range of possibilities-from a few hundred billion to over a trillion dollars in market value. Much depends on execution, innovation, and global AI adoption.

If Palantir continues to grow at 20-25% annually, keeps margins strong, and expands its global customer base, it could become one of the world’s most valuable technology firms by 2040. However, high valuation and competition remain real risks.

In summary, the palantir stock price prediction 2040 is a story of potential and performance. Palantir has the technology, vision, and momentum to thrive. Yet only time will tell whether it reaches the trillion-dollar mark or settles somewhere below it.

Also Read About: NYSE PLTR Financials: Palantir Technologies’ Growth and Performance