NYSE PLTR Financials: Palantir Technologies’ Latest Earnings and Growth

Palantir Technologies (NYSE: PLTR) is always at the centre when it comes to the discussion of artificial intelligence and big data analytics. Palantir, which is known to drive data-driven operations of governments and other privately-owned corporations around the world, has emerged a Wall Street favorite since becoming an enigmatic analytics company. The article goes into detail of the NYSE PLTR financials, covering the income statement, revenue growth, profit margins, and stock performance of Palantir in 2025.

Palantir Technologies and NYSE PLTR Financials.

Palantir Technologies Inc. (NYSE: PLTR) is a software firm that deals with data analytics and AI-based platforms. It has its core products Gotham, Foundry, and AIP (Artificial Intelligence Platform) that find application in processes of defense, government, healthcare and commercial.

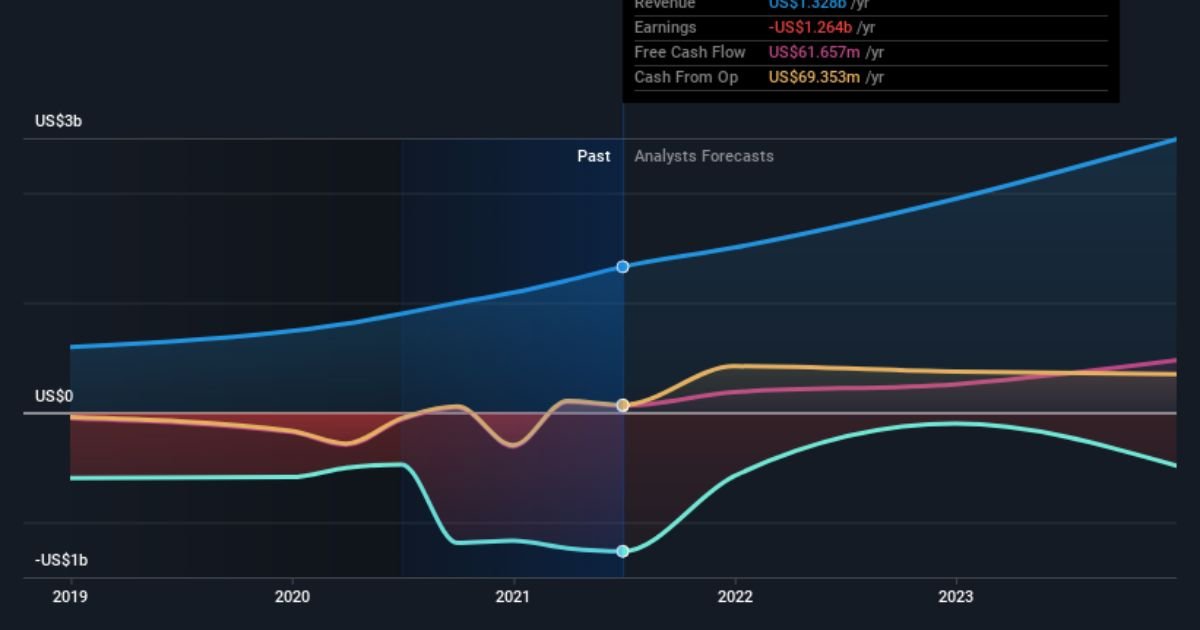

Over the past several years, NYSE PLTR financials have become one of the most debated topics among investors due to the financial gains of the company. Having a mission of scalability, innovation and AI integration, the financial reports of Palantir show a history of deep losses to sustainable profit.

Palantir Income Statement Overview (FY 2020 – TTM 2025)

Data sourced from official NYSE PLTR financial filings.

| Fiscal Year | TTM 2025 | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 |

| Revenue (in millions) | 3,896 | 2,866 | 2,225 | 1,906 | 1,542 | 1,093 |

| Revenue Growth (YoY) | 47.23% | 28.79% | 16.74% | 23.61% | 41.11% | 47.15% |

| Gross Profit (in millions) | 3,148 | 2,300 | 1,794 | 1,497 | 1,202 | 740.13 |

| Operating Income (in millions) | 849.66 | 310.4 | 119.97 | -161.2 | -411.05 | -1,174 |

| Net Income (in millions) | 1,095 | 462.19 | 209.83 | -373.71 | -520.38 | -1,166 |

| EPS (Diluted) | 0.43 | 0.19 | 0.09 | -0.18 | -0.27 | -1.20 |

| Free Cash Flow (in millions) | 1,794 | 1,141 | 697.07 | 183.71 | 321.22 | -308.84 |

| Gross Margin | 80.81% | 80.25% | 80.63% | 78.56% | 77.99% | 67.73% |

| Operating Margin | 21.81% | 10.83% | 5.39% | -8.46% | -26.66% | -107.41% |

| Profit Margin | 28.11% | 16.13% | 9.43% | -19.61% | -33.75% | -106.75% |

Palantir’s Revenue Growth

The stability of the revenues of Palantir is one of the most astonishing facts regarding the NYSE PLTR financials. The total revenue of the company grew between 2020 and 2025 by 3.89 billion dollars (TTM) which is impressive considering the growth in government and commercial contracts.

Although government contracts continue to provide over half of the total revenues, the commercial sector has also become a driving force of expansion, especially in the U.S. The AI Platform (AIP) has proven to be a breakthrough, and businesses are interested in using artificial intelligence to make data-driven decisions.

The 47.23 percent year-to-year increase in revenues indicates that Palantir has a high level of scaleability, as the company has gross margins of over 80 percent.

Profitability and Operating Margins

This is one of the most discussed changes in the financials of NYSE PLTR, as Palantir has turned into a profitable company after making losses. In TTM 2025, the company has reported a net income of 1.09 billion dollars, whereas in 2020, the company has reported a net income of a loss of 1.16 billion dollars.

This turnaround presents a high turnaround in operations. The operating margin increased towards 21.81% in 2025 as compared to negative in the previous year 2020 of -107.41% indicating a high level of cost optimization and control of the research and administrative costs.

The 28.11% profit margin in 2025 highlights the effectiveness of the firm of Palantir in relation to turning the revenue into profits. Furthermore, its free cash flow has almost doubled by 2023, which is 697 million and 2025, which is 1.79 billion that indicates the power of its cash-generating capabilities.

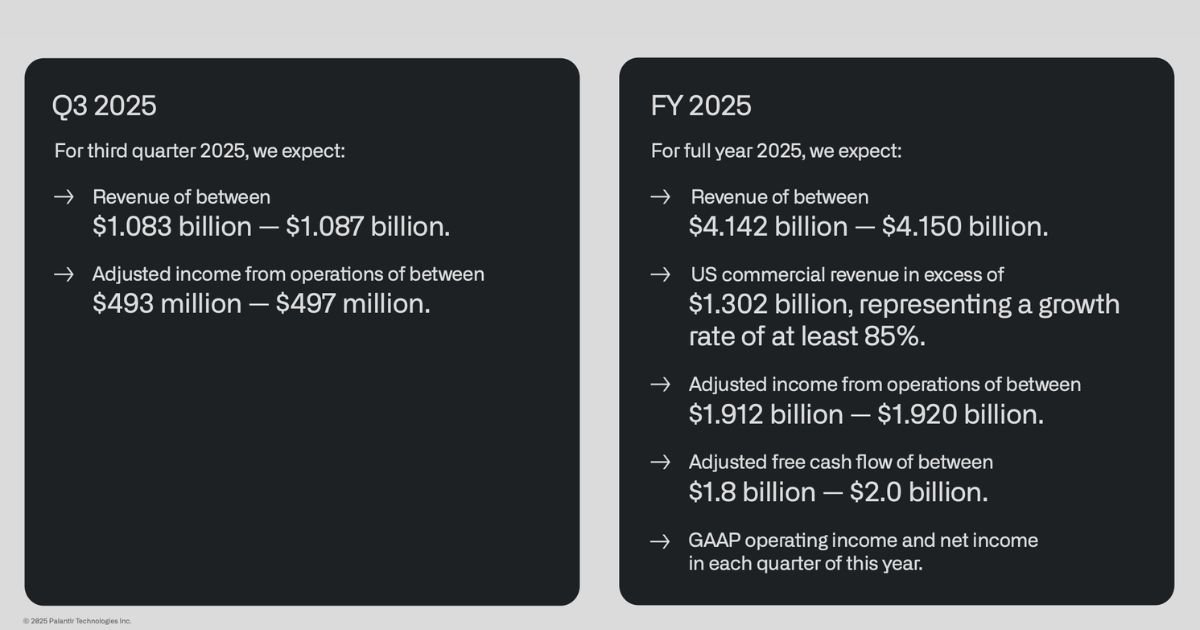

Palantir Q3 2025 Earnings Snapshot

During the Q3 2025 earnings call, Palantir delivered exceptional results across all key metrics.

| Metric | Q3 2025 (Actual) | YoY Growth | Beat / Miss |

| Revenue | $1.18 Billion | +63% | ✅ Beat |

| Adjusted EPS | $0.21 | +200% | ✅ Beat |

| Operating Margin (Adjusted) | 36% | +6 pp | ✅ Beat |

| Free Cash Flow (FCF) | $694 Million | +129% | ✅ Beat |

| FY 2025 Revenue Guidance | $4.55 – $4.60 Billion | Raised | ✅ Beat |

Despite the strong earnings, the Palantir stock (NYSE: PLTR) dropped over 4% in after-hours trading, surprising many investors.

Why Did Palantir Stock Fall Despite Strong Financials?

Valuation issues can explain the decrease in the share price of Palantir following earnings. By the time of the outcomes, PLTR had a forward earnings and forward sales valuation of close to 90x and 25x respectively, which is only the prerogative of hyper-growth startups and not the maturing software giant.

The results were considered to be already priced in by investors. Even good numbers may fail to propel further upwards when the expectations are high. Seeking Alpha and Morningstar analysts said Palantir was a high-expectation stock, where perfection is required every quarter.

This is the typical response of sell-the-news when the stock surges before earnings and investors sell off profits later.

Government Contracts and Business Development

The NYSE PLTR financials are still supported by government contracts, which guarantee the financial stability and frequent income. But there is also the risk of depending on the U.S. budget cycle – government funding delays would temporarily impact profits.

The business side, however, is doing fine. The commercial revenue increased by more than 80 percent annually at Palantir, primarily because of the rise in the usage of AIP by the private business in the U.S and Europe. The firm is also diversifying into healthcare, energy, and finance – the areas that can be served using the predictive data models of Palantir.

Analyzing the Market Situation of Palantir

The emergence of Palantir is directly related to the AI revolution. Nonetheless, with the increased congestion in the AI industry, AI stocks have gone soaring. Although the NYSE PLTR financials indicate strong fundamentals, investors are worried about the overvaluation during an event that may be the AI bubble.

Other analysts compare the valuation of Palantir to early-stage Nvidia or Snowflake, albeit without the same amount of scale or profitability margin. Thus, the institutional investors will rate it as a long hold as opposed to an immediate purchase.

The Future of Palantir and NYSE PLTR Financials

Palantir’s long-term vision remains clear — to become the operating system for enterprise and government AI. The company’s consistent profitability, expanding commercial client base, and strong free cash flow provide confidence for sustained growth.

Future growth catalysts include:

- Wider adoption of the AI Platform (AIP) in global enterprises.

- New government contracts from NATO allies and U.S. defense sectors.

- Diversification into healthcare, energy, and financial analytics.

However, valuation discipline will remain crucial. The market will reward Palantir not just for innovation, but for maintaining sustainable growth without overvaluation risks.

Conclusion: Palantir’s Financial Power and Market Reality

Analyzing NYSE PLTR financials, one thing is clear – Palantir has transformed from a loss-generating data analytics company to an AI-based profit-generating organization. The company’s strong revenue increases, operating margin, and cash flows substantiate its good financial position.

That said, the stock’s relatively high volatility exemplifies the gap between good fundamentals and high investor expectations. For investors, the takeaway is easy – Palantir’s fundamentals are good, but its stock movements in the shorter term will depend on how the market views its potential.

Palantir Technologies (NYSE: PLTR) is not only a representation of the promise of AI, it is also an instance of innovation against the psychology of an investor on Wall Street.

Also Read About: Will Palantir Stock Hit $1000? Palantir Stock Price Prediction 2040