Does Palantir Pay Dividends? Insights into Its Financial Strategy

Palantir Technologies Inc. (NYSE: PLTR) is one of the most talked-about growth stocks in the market. In the past three years alone, its stock has delivered astonishing returns of more than 1,200%, making it a favorite among growth-focused investors. With Palantir becoming profitable and showing strong revenue growth, many investors naturally ask: Does Palantir pay dividends? Or will it pay dividends in the future? This article will explore Palantir’s financial situation, growth strategy, and what this means for dividend payments.

Palantir’s Business Overview

In 2003, Peter Thiel was one of the co-founders of Palantir. Some of the most successful technology ventures, such as PayPal and Met,a have been initiated by Thiel. Palantir is a company that deals with data analytics software that can assist governments and firms in comprehending vast quantities of information.

The company has four main platforms:

- Gotham: Used by government agencies and defense organizations to identify patterns in complex datasets.

- Foundry: Acts as a central operating system for a company’s data, allowing integration and analysis in one place.

- AIP (Artificial Intelligence Platform): Helps automate many business processes and allows creation of AI apps.

- Apollo: Provides software deployment solutions including security, compliance, and SaaS services.

These platforms are widely used in intelligence, defense, healthcare, finance, and other industries, giving Palantir a diverse customer base and strong growth potential.

Palantir Platforms

| Platform | Purpose | Main Users |

| Gotham | Identify patterns in datasets | U.S. Intelligence, Defense |

| Foundry | Central data operating system | Businesses across industries |

| AIP | Automate business processes | Companies using AI |

| Apollo | Software deployment and compliance | Government and commercial clients |

Palantir’s Growth and Financial Performance

Palantir went public on September 30, 2020, opening at $10 per share. Today, it trades above $130 per share, with a market cap exceeding $300 billion, making it a mega-cap stock.

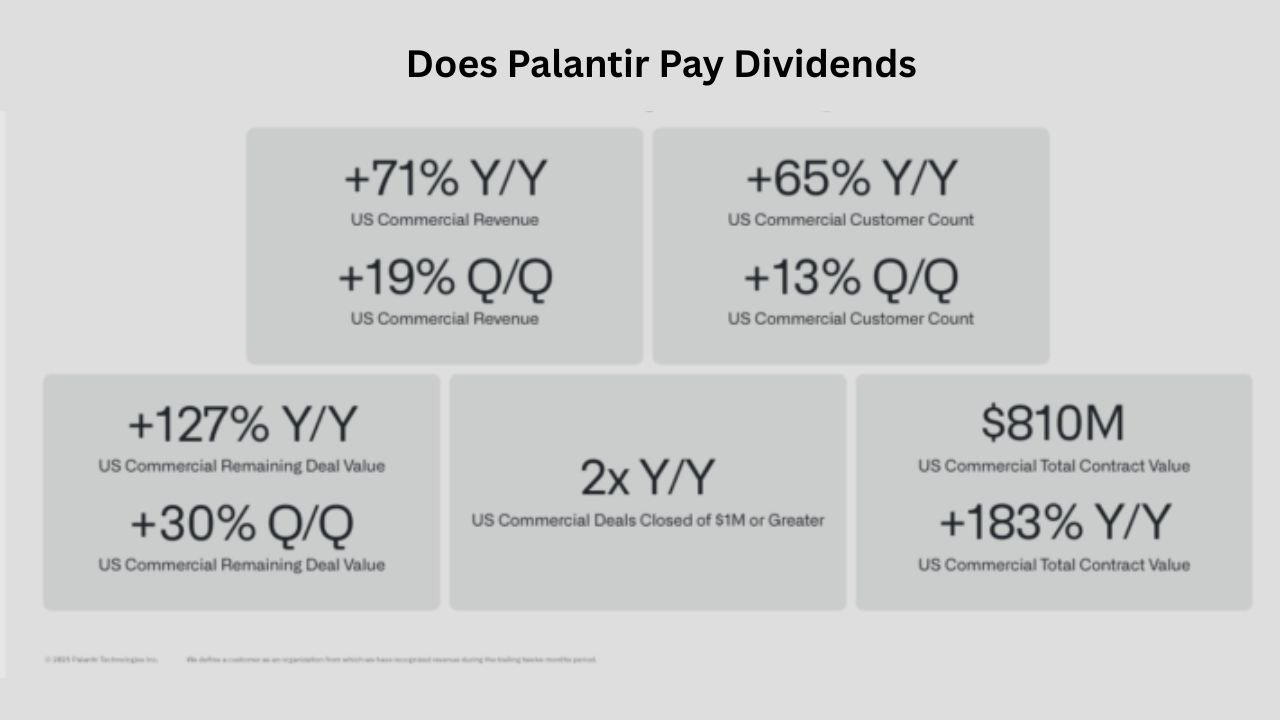

In May 2025, Palantir posted a first-quarter revenue of $883.85 million, which was more than the analysts had estimated. Its revenue in the U.S. went up by 55 percent every year, and commercial income in the U.S. rose by 71 percent.

In the first quarter, the company transacted 139 deals of at least 1 million dollars each, and this indicates high customer demand. It is also growing internationally, and this is an indication that there are more growth prospects in the future.

Does Palantir Pay Dividends?

Currently, Palantir does not pay a dividend. Despite being profitable, the company reinvests most of its cash into growth initiatives, research and development, and expanding its market reach.

Many investors in young growth companies like Palantir do not expect dividend payments because reinvesting profits usually generates higher long-term returns than paying out a small dividend.

Palantir Dividend Status

| Metric | Status |

| Dividend Paid in Last 12 Months | No |

| Dividend Yield | 0% |

| Current Dividend | None |

| Expected Dividend in Near Future | Unlikely in next 5-10 years |

Why Palantir Could Pay Dividends in the Future

Palantir has strong cash reserves, which means it could pay a dividend if it chose to. As of the most recent quarter, the company had:

- $5.43 billion in cash and cash equivalents

- $6.28 billion in current assets

- $976.4 million in current liabilities

This shows that Palantir has strong liquidity, with plenty of cash available to fund operations or potentially pay dividends in the future.

Palantir Financial Snapshot

| Metric | Value (USD) |

| Cash & Cash Equivalents | 5.43B |

| Current Assets | 6.28B |

| Current Liabilities | 976.4M |

| Market Capitalization | 300B+ |

Why Palantir Is Not Paying Dividends Now

Even though Palantir is profitable, the company is still in a high-growth phase. Growth companies often:

- Reinvest earnings into R&D and expansion

- Spend on sales and marketing to gain more customers

- Build new platforms and technologies to maintain a competitive advantage

As an illustration, the operating expenses at Palantir have increased 22 percent per annum, which indicates the company has invested in the expansion of its business. The dividend would help lower the cash available to grow the company, which is not the best choice in a company that is still growing.

Even a 50% dividend would leave the quarterly dividend at less than a fifth of the current level of 0.37, or at about 0.05 per share, less than a percent yield at the present price, which is not income-attractive to the investor.

Palantir’s Growth Strategy Over Dividend Payouts

Palantir is focused on long-term growth, which is why reinvestment is preferred over dividends. The company can use its cash reserves to:

- Acquire new companies or technologies

- Expand international operations

- Improve and scale its software platforms

Investors in Palantir are typically looking for stock price appreciation and total returns, rather than small dividend income.

Uses of Palantir’s Cash

| Use | Purpose |

| Reinvestment in R&D | Create new platforms and AI capabilities |

| Expansion | Enter new international markets |

| Acquisitions | Buy complementary technologies or companies |

| Dividend Payments | Currently not prioritized |

Final Thoughts on Palantir and Dividends

Since its IPO, Palantir has been an impressive growth stock and has brought high returns to its shareholders. It has used its platforms and technology to create profits and cash flow, and dividends are not within its present strategy.

Investors need to consider Palantir as a growth-oriented investment, which is driven by stock upsurge and long-term increase, and not dividend payouts. Probably, your Palantir would not distribute a single dividend within the next five or ten years because it keeps investing in growth and expansion.

Also Read About: Who Owns Palantir? | Its Shareholders and Ownership Structure