Five Reasons Why Investors Might Want to be Cautious on Palantir Stock (PLTR)

Palantir Technologies Inc. (NASDAQ: PLTR) has become one of the hottest names in the artificial intelligence (AI) and data analytics world. Over the last two years, its stock has skyrocketed, giving early investors massive returns. With big government contracts, a strong presence in AI, and consistent media buzz, it is easy to see why Palantir Stock is considered one of the leading technology players of the decade. However, while the company’s story looks promising, investors must not ignore the risks that come with such explosive growth. In this article, we will explore five major reasons why Palantir stock may not continue its upward journey and why its valuation could face a sharp correction in the future. This isn’t to deny Palantir’s achievements but rather to give a balanced perspective for long-term investors.

1. Next-Big-Thing Technologies Always Face Bubbles

We have seen in history that any revolutionary technology, be it the internet in the 90s, cloud computing in the 2000s, or electric vehicles more recently than that, has all experienced a bubble phase. The investors initially anticipate immediate adoption and immediate returns, but the truth is that things are not as fast. Business organizations take years to adopt these technologies successfully.

AI is currently experiencing this same cycle. While Palantir has secured contracts and its software is widely used, the overall industry is still maturing. Many businesses are experimenting with AI but are not yet generating positive returns on their investments. This creates a risk that Palantir stock could face downward pressure when investor enthusiasm cools down, even if its revenues remain stable.

2. Gotham’s Growth Ceiling Is Lower Than Expected

- Gotham’s Core Role: Palantir’s Gotham platform has been the backbone of its growth, especially through partnerships with the U.S. government.

- Key Uses: Gotham supports federal agencies in intelligence gathering, mission planning, and data analysis.

- Market Limitation: Unlike Palantir’s commercial platform Foundry, Gotham cannot be sold to countries that are not close allies of the U.S.

- Restricted Global Reach: This restriction limits Palantir’s ability to scale Gotham on a worldwide level.

- Future Prospects: Gotham will likely continue winning contracts with Western governments.

- Growth Ceiling: The long-term growth potential of Gotham is lower than many investors assume.

- Investor Implication: Current investors may be overestimating Gotham’s role in Palantir’s sustained rapid expansion.

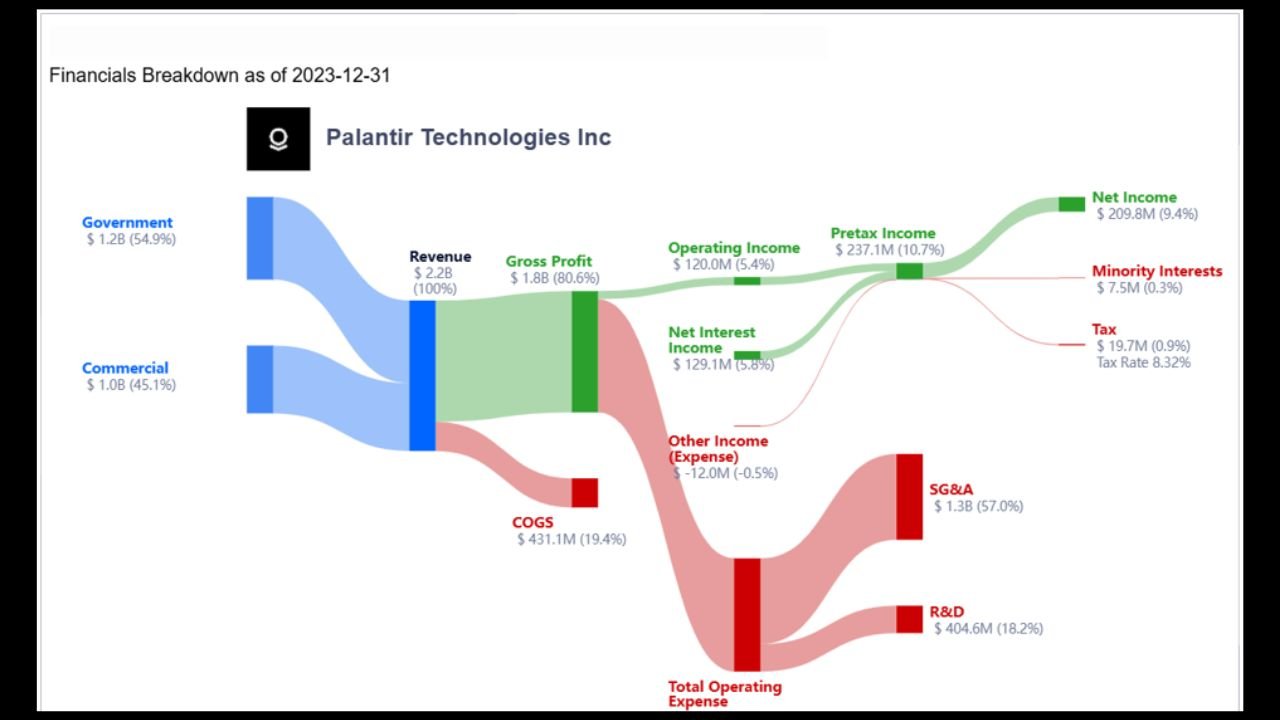

3. Poor Earnings Quality Creates Concerns

On the surface, Palantir looks very profitable. It has shifted to recurring profitability earlier than Wall Street expected. But digging deeper shows a different picture. A significant portion of its earnings comes from interest income on its cash reserves, not just from its operations.

Indicatively, in 2024, interest income generated 40 percent of the pre-tax income obtained by Palantir. At the beginning of 2025, that number was even above 20%. Although there is nothing bad in getting interest, it is not the actual business strength of Palantir. If interest rates decline in the future, this revenue will decline drastically, revealing the dependence of Palantir on the short-term financial terms.

Investors should be aware that strong headline profits don’t always mean the company’s core business is delivering equivalent strength.

4. Share Dilution from Stock-Based Compensation

Overreliance on stock-based compensation is another significant issue to Palantir. The company also shares stock options periodically to retain talent and motivate employees. Although it is typical of Silicon Valley, the impact on the shareholders can be devastating.

Whenever Palantir issues new shares, the worth of the old shares is watered down. The hype on AI and the unending Palantir stock demand have so far obscured this dilution effect. However, in the long run, the investors can be affected by the reduction in earnings per share and share percentages.

This is among the reasons why skeptics are convinced that the Palantir stock rise may not be long-term unless the firm shuns the reliance on stock-based rewards.

5. Insider Selling Raises Red Flags

The insiders, executives, and directors at Palantir have sold over 7 billion worth of shares since their IPO in 2020. Although there is a normal amount of selling, this pattern of consistency in insider selling over a prolonged period of almost five years indicates that even the leadership at Palantir is worried about the valuation of the company.

What is even more worrisome about this is the absence of insider buying. Since the latest insider purchase was the only one in the past 57 months, the question that investors might be asking is why company executives, who understand the company the best, are not ready to stake more in it.

This tendency contributes to the discussion that Palantir stock may be overpriced against its long-term fundamentals.

Palantir’s Sky-High Valuation

- Valuation Concerns: Palantir currently trades at a price-to-sales (P/S) ratio above 100.

- Comparison with Tech Giants: This valuation is much higher than historic peaks reached by companies like Microsoft, Amazon, and Nvidia.

- Market History: These major tech firms experienced sharp stock price corrections when their valuations became unsustainable.

- Priced for Perfection: Even if Palantir grows revenue significantly, its current valuation already assumes near-perfect execution.

- High Risk of Correction: Any slowdown in growth, contract losses, or negative news could spark a major decline.

- Analyst Warning: Experts suggest Palantir’s stock could fall by as much as 60% if market sentiment turns.

Palantir News and Recent Developments

Over the past few months, Palantir has been in the news with numerous new contracts with the government, including the Department of Defense and Immigration and Customs Enforcement. The developments have contributed to the momentum of the stock and are frequently discussed in Palantir News and analysis stories.

Note, however, that even though the contracts enhance short-term confidence, the long-term issues of valuation, insider selling, and suppressed global expansion of Gotham still prevail, and thus,the investors who have been following the news of Palantir stock.

Quick Overview of Palantir’s Strengths and Risks

| Category | Strengths | Risks |

| AI Leadership | Strong government and commercial platforms | AI industry still maturing, bubble risk |

| Gotham Platform | Key U.S. government contracts | Limited market outside allied countries |

| Profitability | Shifted to recurring profits | Heavy reliance on interest income |

| Employee Compensation | Attracts top tech talent | Dilution from stock-based pay |

| Insider Activity | Successful IPO and big stock growth | $7+ billion insider selling, little insider buying |

| Valuation | Market cap above $400B with growth potential | P/S ratio above 100, historically unsustainable |

Conclusion

Palantir Technologies has achieved extraordinary success in the AI and data analytics space. Its software platforms—Gotham and Foundry—are being used by both government agencies and businesses, making it an important player in the digital economy. Yet, despite its strengths, there are serious risks investors cannot ignore.

From the risk of an AI bubble to poor earnings quality, stock dilution, insider selling, and an extremely high valuation, Palantir stock carries warning signs. Investors following the latest Palantir News and palantir stock news updates should carefully evaluate whether the company’s fundamentals justify its current price.

In the end, while Palantir could remain a strong player in the AI race, its stock may face significant challenges ahead. For cautious investors, it may be wise to wait for a more reasonable entry point before buying into the hype.

Also Read About: PLTR Robinhood: Comparing Palantir and Robinhood Stock in 2025