PLTR Earnings 2025: Key Updates for Investors

Palantir Technologies, known by its ticker symbol PLTR, has become one of the most followed companies on Wall Street. With its strong focus on artificial intelligence, big data, and government contracts, investors around the world closely track the company’s financial performance every quarter. One of the most searched questions by traders is “when is PLTR earnings”, because the release of results often creates big movements in the stock price.

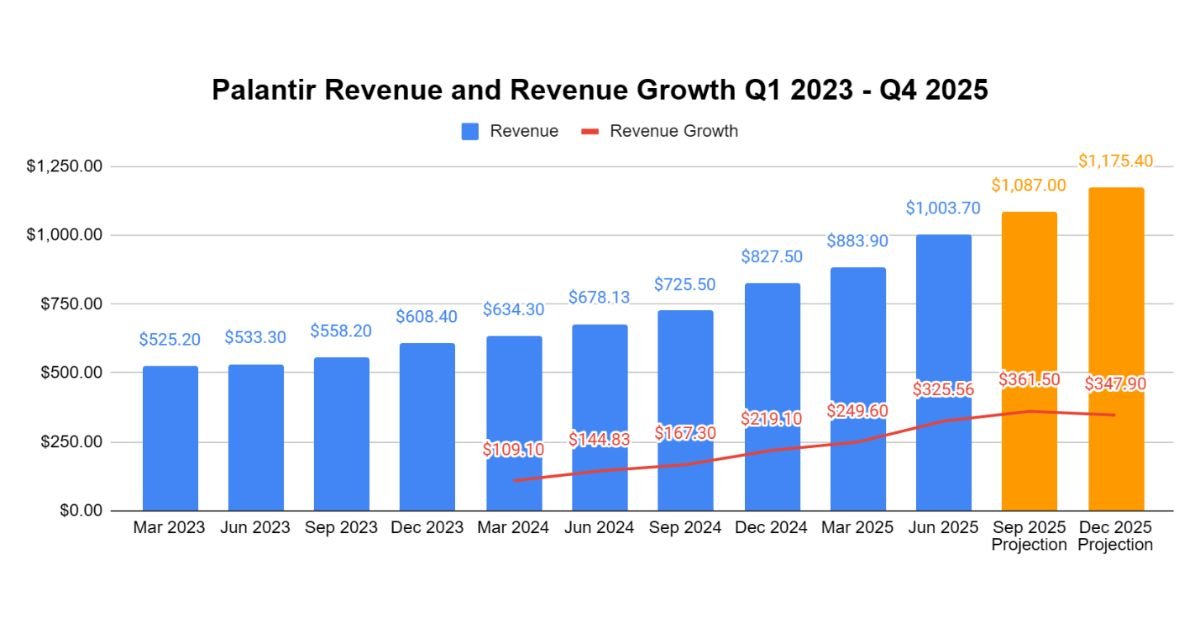

The year 2025 has already been an important one for Palantir. The company reported record-breaking revenue in the second quarter, and investors are waiting to see how the upcoming results will shape the company’s growth story. In this blog, we will discuss the earnings history, expected earnings, the confirmed and forecasted earnings dates, and what this means for investors looking at PLTR.

Know About PLTR Earnings Reports

An earnings report is an update report that companies post quarterly to demonstrate their financial status. In Palantir Technologies (PLTR), it is not merely a number, but a demonstration of the rate of expansion of the company in both the commercial and government sectors.

Investors monitor earnings per share (EPS), revenue, and contracts that are signed on a quarter-to-quarter basis. An increase in the earnings per share occurs when PLTR exceeds the earnings estimate. Conversely, failure of the company to meet expectations may result in a short-term slump. That is why the trend when PLTR earnings are followed on Google and financial news outlets before every report.

Upcoming PLTR Earnings Date

The next PLTR earnings date is written as November 3, 2025, in accordance with Zack and Wall Street Horizon data, but it has not been proven yet. The third quarter of 2025 will reflect the earnings, and the earnings per share are estimated to be $0.17, which will be a significant improvement over the earnings per share of last year at the same quarter of 2025, which was 0.10 at the same time.

Palantir has already displayed steady growth in 2025, and shareholders are anticipating that the organization will continue with its positive results. The market will be keen on whether or not PLTR will be able to outrun the forecast once again.

PLTR Earnings Table 2025

To make it easy for investors to track, here is a table of recent and expected PLTR earnings:

| Report Date | Period Ending | Estimate EPS | Reported EPS | Surprise | % Surprise | Time |

| 11/03/2025 (Expected) | Q3 2025 | $0.17 | – | – | – | After Market |

| 08/04/2025 | Q2 2025 | $0.14 | $0.16 | +0.02 | +14.29% | After Market |

| 05/05/2025 | Q1 2025 | $0.13 | $0.13 | 0.00 | 0.00% | After Market |

| 02/03/2025 | Q4 2024 | $0.11 | $0.14 | +0.03 | +27.27% | After Market |

| 11/04/2024 | Q3 2024 | $0.09 | $0.10 | +0.01 | +11.11% | After Market |

| 08/05/2024 | Q2 2024 | $0.08 | $0.09 | +0.01 | +12.50% | After Market |

| 05/06/2024 | Q1 2024 | $0.08 | $0.08 | 0.00 | 0.00% | After Market |

| 02/05/2024 | Q4 2023 | $0.08 | $0.08 | 0.00 | 0.00% | After Market |

| 11/02/2023 | Q3 2023 | $0.06 | $0.07 | +0.01 | +16.67% | Before Open |

| 08/07/2023 | Q2 2023 | $0.05 | $0.05 | 0.00 | 0.00% | After Market |

This table shows that PLTR has beaten estimates in most quarters, which has built investor confidence in its growth potential.

Earnings Growth in 2025

The highlight of 2025 so far has been Palantir’s performance in the U.S. market. The company crossed $1 billion in quarterly revenue for the first time in Q2 2025, showing strong demand for its AI and data-driven platforms. The U.S. commercial revenue grew by 93% year-over-year, while government revenue increased by 53%.

Another big achievement was the 10-year, $10 billion contract with the U.S. Army, which secures long-term business and steady income for the company. This kind of government deal not only boosts revenue but also increases investor trust that Palantir’s technology is valuable at the highest levels of national security.

Investor Interest Around PLTR Earnings

Whenever investors inquire about when PLTR earnings will be, it is a sign of the significance of such financial reports. The dates that contain earnings attract a lot of trading, and the stock usually experiences a huge price fluctuation during these dates. Traders seek to either capitalize on a possible beat of earnings or hedge against a possible miss.

To long-term investors, earnings are a means of ensuring that the company is on the right track. As AI and data solutions become increasingly useful in the global economy, the high growth of the earnings of company is an encouraging indicator to the stockholders who may be holding the stock in the long run.

Stock Price and Consensus

Along with earnings, investors also watch how analysts rate the stock. As of September 2025, Palantir’s stock price is trading between $153 and $177, with a consensus EPS forecast of $0.17 for Q3 2025. Many analysts currently rate the stock as a “Hold,” but the strong financial performance and growth guidance may change this outlook in the future.

The rise in revenue, improvement in profitability, and large contract wins have given PLTR a strong base to continue expanding. If the company beats expectations again in November, it could push the stock price higher.

Final Thoughts

Palantir Technologies has become one of the most closely tracked companies in the market because of its role in artificial intelligence and government contracts. The question “when is PLTR earnings” is important because the release of results gives investors a clear view of the company’s health and growth.

The next earnings date of November 3, 2025, will be a crucial one, and the market anticipates a figure of 0.17 EPS, which will mean massive growth on a year-over-year basis. Based on the history of earnings, Palantir has exceeded estimates on many occasions, which is a good indicator that a favorable surprise could occur once again.

To investors, the value of PLTR earnings is not a quarterly one but a means to gauge the long-term value of the company. Having record revenue, good U.S. contracts, and increased demand for AI solutions, Palantir is a company to follow in 2025 and further.

Also Read About: Palantir Stock Forecast 2025–2030: Price Prediction, Growth Potential & ROI