Palantir AI Stock Growth Potential: Analysis of Strengths, Risks, and Future Outlook

Artificial Intelligence has rapidly become one of the most disruptive forces in today’s financial markets. Among the companies at the heart of this transformation, Palantir AI has captured massive attention due to its unique ability to combine big data analytics with advanced AI-driven decision-making tools. Over the past few years, Palantir’s stock has witnessed remarkable growth, making it one of the most talked-about AI-driven companies on Wall Street. However, when looking at the Palantir AI stock growth potential, investors must also weigh the risks, competition, and long-term sustainability of such extraordinary gains.

This article explores Palantir AI’s strengths, its performance in the stock market, growth prospects, challenges, and even comparisons with other AI-focused companies like Alphabet and Snowflake.

Palantir AI: Revolutionizing Data Analytics

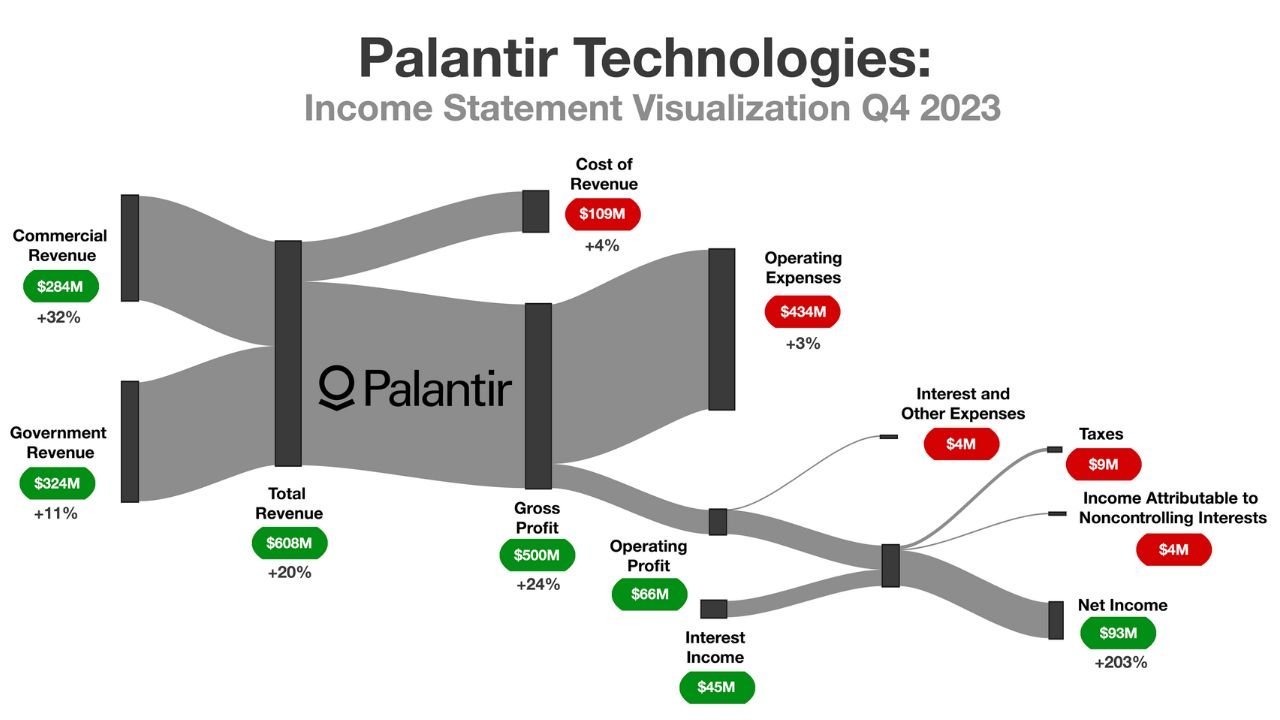

Palantir was originally a government-oriented data analytics firm, used to assist intelligence and defense agencies with large amounts of data. As time progressed, the company branched out into the commercial market, where companies could apply its platforms, such as Foundry and Apollo, to get AI-driven insights.

Palantir AI is strong because it can convert raw data into operational intelligence. It is used by governments as a security measure, fraud detector and counter-terror tool and by corporations for supply chain optimization, predictive modeling, and customer behavior analysis. This two-fold interest in government and enterprise segments has enabled Palantir to win long-term contracts and diversify its revenues.

The Rise of Palantir’s Stock

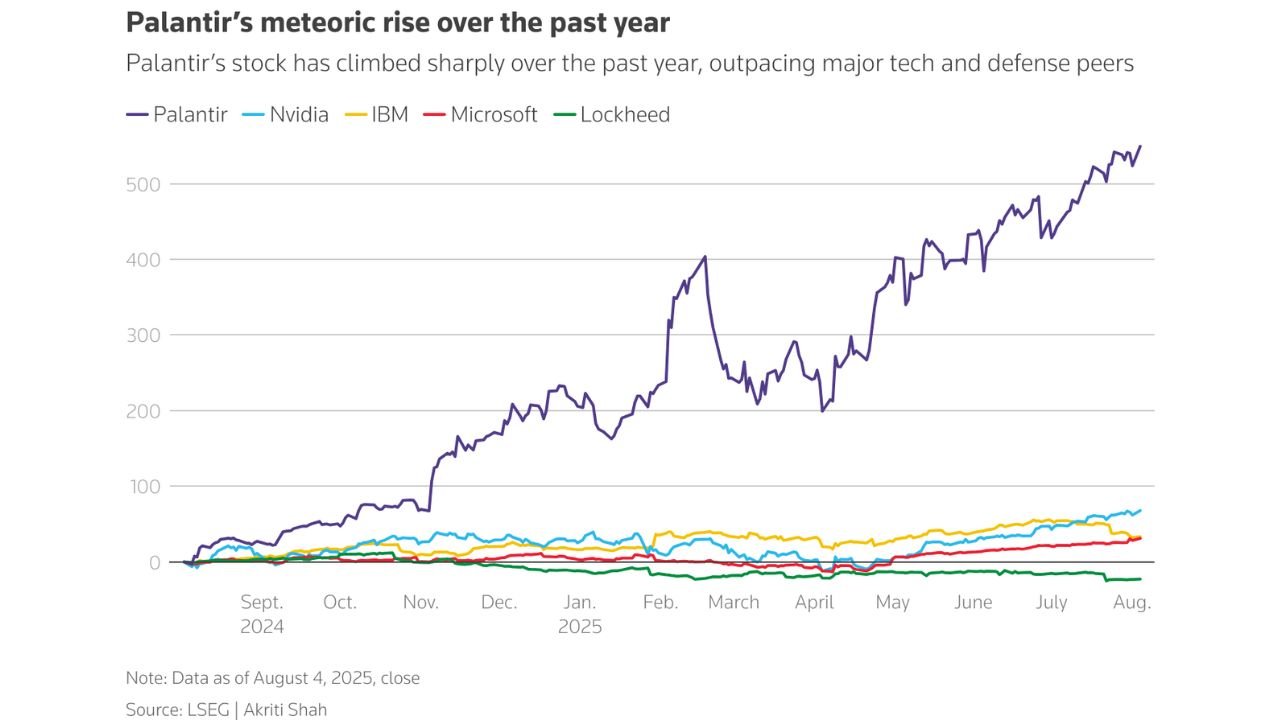

The stock market performance of Palantir has been nothing short of dramatic. Since 2023, Palantir AI stock has grown more than 2,000%, making it a favorite among retail traders and institutional investors alike. In Q2 2025, the company reported revenue growth of nearly 48% year over year, reaching the $1 billion mark for the quarter. Such explosive growth numbers have created strong optimism about its future.

However, the very speed of this growth has led to some concerns. Analysts point out that much of the Palantir AI stock growth potential is already priced into the current valuation. With a forward price-to-earnings ratio far above the industry average, Palantir carries high expectations, and even small disappointments in earnings could lead to sharp corrections.

Why Investors Are Excited About Palantir AI

It is not in vain that Palantir AI is making headlines. The company is ideally placed at the intersection of big data and artificial intelligence, two industries that will expand exponentially in the next decade. The demand to implement dependable AI-based systems to handle and analyze data is only growing as more organizations turn to digital transformation.

The relationships of Palantir with governments, health care systems, and Fortune 500 companies create a certain stability and a certain degree of credibility that not all smaller AI companies will have. This massive adoption guarantees that Palantir AI is not but a passing fad in the AI ecosystem.

Valuation Concerns and Market Risks

High valuation is one of the largest threats to Palantir. Having a forward earnings multiple of more than 200 and a price-sales ratio of more than 100 during some quarters, Palantir is currently trading at a premium relative to other technology firms. Investors are literally placing bets that the company will manage to maintain high growth rates over the next many years.

The issue is whether Palantir is able to sustain growth of 40 percent within the next five years and still achieve profitability that could justify its valuation. This can be done considering its position in the market, but it does not leave much room to make a mistake. Sluggish government purchases, regulatory risk, or successful competitors such as Microsoft, Alphabet, or Snowflake would influence the stock direction of Palantir.

Comparing Palantir AI with Other AI Leaders

In order to assess the potential of the Palantir AI stock growth, we should compare it with the other industry leaders in the AI sector. Alphabet, which has managed to embed generative AI into its products, remains dominant in search, and its dominance is guaranteed in the long term. Instead, Snowflake is emerging as a significant force in cloud data storage and analytics that are powered by AI.

Here’s a table comparing Palantir with Alphabet and Snowflake based on valuation, revenue growth, and market potential:

| Company | Market Cap (2025) | Revenue Growth (Q2 2025) | Forward P/E | Price-to-Sales | Core AI Focus |

| Palantir | $377 Billion | 48% YoY | ~245 | ~117 | AI-driven analytics for government & enterprise |

| Alphabet | $4.3 Trillion | 14% YoY | ~21 | ~6.9 | Generative AI in search, cloud AI |

| Snowflake | $80 Billion | 32% YoY | ~90 | ~17 | Cloud data + AI integration |

Based on this table, it is clear that the growth rate of Palantir is significantly higher, but at the same time, its valuation is also very high in comparison with its competitors. Alphabet is slower in growth, though safer in value, whereas Snowflake is in the middle range with high growth and a relatively lower price than Palantir.

Predictions for Palantir AI Stock Growth Potential

Looking forward, most commentators are optimistic that Palantir will see further growth in both government and the business sector. Assuming Palantir can maintain a roughly 3040 percent revenue growth rate over the next five years and then adjust to 1520 percent revenue growth thereafter, the company can potentially achieve more than $35 billion in revenue by 2035. Palantir is projected to have more than 12 billion in annual profits with a profit margin of approximately 30-35.

The returns will, however, not be as dramatic as the last couple of years because much of the potential is already embodied in the current high stock price. Investors are likely to see slower, more consistent growth, and Palantir may end up becoming one of the most successful global AI providers over time instead of providing short-term returns that are explosive.

Risks of Overdependence on AI Hype

Another factor that must be considered is the broader AI hype cycle. While artificial intelligence is undoubtedly transformative, investor enthusiasm often leads to inflated valuations across the sector. Just like the dot-com bubble in the late 1990s, AI-related stocks could experience volatility if expectations do not match actual results.

In the case of Palantir, it has to ensure it keeps producing high profits, increase the number of customers and innovate to remain ahead of its competitors. Any lag in the adoption of AI or inability to sustain contracts may hurt its growth prospects in the stock market.

Long-Term Outlook: A Balanced Perspective

In the long term, Palantir AI stock growth potential remains strong, but it requires a balanced perspective. Palantir is not just another AI company; it has deep roots in government contracts, a growing commercial portfolio, and strong brand recognition. These factors create a powerful foundation for future expansion.

Yet, investors must also be cautious. Valuation concerns, competition, and changing market dynamics all pose real risks. The best strategy may be to consider Palantir as part of a diversified AI investment portfolio, balancing its high-growth potential with safer, more stable tech giants like Alphabet and Microsoft.

Conclusion

Palantir AI has established itself as one of the most exciting AI companies in today’s market, with rapid growth and an expanding role in both government and commercial sectors. Its stock has delivered phenomenal returns, and the Palantir AI stock growth potential remains attractive for long-term investors who believe in the future of artificial intelligence.

But the sky-soaring valuation of Palantir suggests that much of this potential is already captured, with future returns being less assured. When compared to Alphabet and Snowflake, it is evident that Palantir has the highest growth, but it is also the riskiest.

Investors have a choice of either growth or valuation. Palantir AI will probably keep playing a leading role in the AI revolution, but its future performance against other tech giants will depend on how well it sustains high growth, adapts to competition, and maintains the premium valuation.

Also Read About: Palantir Stock Price Prediction 2030: Can PLTR Reach $1 Trillion?